Used to enter payments and distribute payments to

orders/invoices.

Payment Entry Step 1:

§

Payment

by: select the payee type as either Company

or Individual. The default selection is Company.

§

Order /

Invoice #: if known enter the Order Number.

§

Contact

ID: if known enter the Contact ID.

§

Company

ID: if known enter the Company ID.

§

: use to cancel the payment entry. Closes the page without saving anything.

: use to cancel the payment entry. Closes the page without saving anything.

§

: use

to proceed to the next step of the payment entry process. The next step is dependent on the information

entered in step 1. If either

Order/Invoice#, Contact ID, or Company ID are entered; the Search for

Contacts/Companies step is skipped.

: use

to proceed to the next step of the payment entry process. The next step is dependent on the information

entered in step 1. If either

Order/Invoice#, Contact ID, or Company ID are entered; the Search for

Contacts/Companies step is skipped.

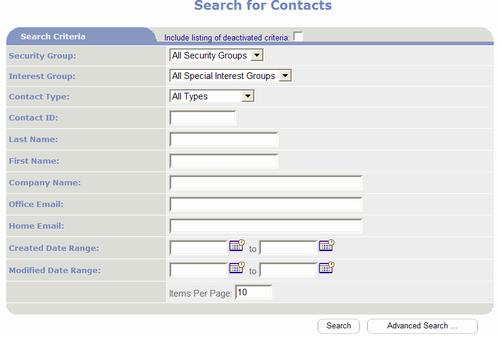

Search for

Companies:

This step occurs when you set Step 1: Payment By to Company.

The purpose of this step is to identify the payee.

§

ID –

this column lists the Company IDs as links that when clicked on displays the companies’

record in the Company Management page.

When a Company Name is listed without an ID, this means that the company

name was entered into a contact record but a company record has not been

created.

§

Company

Name – this column lists the company names.

When the Company Name is listed as a link (underlined) this means a

company record has been created for the company and you may click on the link

to retrieve the company record in the Company Management page. If the Company Name is listed without link

(not underlined), this means the company name was entered into a contact record

but a company record has not been created.

See Contact Management feature for additional information.

§

Select

– click on the select link to select the company and proceed to Payment Entry

Step 2.

Search for

Contacts:

This step occurs when you set Step 1: Payment By to Individual. The purpose of this step is to identify the

payee.

§

ID –

this column lists the IDs as links that when clicked on displays the contact’s

record in the Company Management page.

§

Contact

Name – this column lists the contact names as links that when clicked on displays

the contact’s record in the Company Management page.

§

Select

– click on the select link to select the contact and proceed to Payment Entry

Step 2.

Payment Entry

Step 2

§

Payment

Date: defaults to the current date.

Typically this is used to record the date the payment was received.

§

Company

Name: if the payee is a company, the

companies name is displayed here.

§

Contact

Name: if the payee is an individual, the individuals name is displayed

here.

§

Payment

Type: select one from one of the

available payment types. Payment types enabled

in Payments Feature Management.

§

Name on

Card or Check: enter the name exactly as it is printed on the check or

credit card.

§

Number: enter the credit card number or the check

#. When the payment type is set to a

credit card, a number is required. PORTALPRODIGY will verify the correct starting

number and quantity of digits based on the type of credit card. When entering checks, the check number is

optional.

§

CSC#:

optional input used for credit card payments only. Some credit card processor requires CSC

verification. This is a number that is

typically printed on the back of the credit card and is used as an extra

security precaution to minimize fraudulent use of credit cards.

§

Expiration

Date (Month /Year): if payment is by

credit card, a credit card expiration date is required. Enter the month using numbers, e.g. 1 for

Jan., 12 for Dec. The year should be

entered as a 4 digit number, e.g. 2007.

§

Payment

Amount: enter the dollar amount of

the payment. Cents are entered using a

decimal, e.g. enter 9.95 for $9 and 95 cents.

§

Payment

Status: when the selected payment

type requires authorization this field is used to set and track the

authorization status. The default value

is Pending. This value can be changed to either Approved or Declined. Orders requiring

pre-payment prior to fulfillment/shipment require the applied payments to have

their Payment Status set to Approved. If you will be entering an authorization

number, this field can be left blank. When PORTALPRODIGY processes the payment

it will automatically set the Payment Status to Approved when an authorization number has been entered.

§

Address: for credit card payments, if your processor

requires address verification, you must enter the billing address for the

credit card. Enter the street address

into this field.

§

City: for credit card payments, if your processor

requires address verification, you must enter the billing address for the

credit card. Enter the City into this

field.

§

Country: for credit card payments, if your processor requires

address verification, you must enter the billing address for the credit

card. Enter the Country into this

field. It defaults to the value

specified in User Signup Features Management.

§

State

/Province: for credit card payments,

if your processor requires address verification, you must enter the billing

address for the credit card. When

country is set to USA,

Canada or Mexico,

this field is displayed as a list box listing the corresponding

States/Provinces. For all other

countries the field is set to a text box.

It defaults to the value specified in User Signup Features Management.

§

Zip /

Postal Code: for credit card payments, if your processor requires address

verification, you must enter the billing address for the credit card. Enter the Zip /Postal Code into this field.

§

Authorization

#: used to enter either the check or

credit card authorization number provided by your processor or banking

institution.

§

Include

Paid Invoices: defaults to No.

Set to Yes, when you want to

view Paid Orders/Invoices on the Payment Distribution page.

§

Memo: use this for internal purposes to record

notes about the payment. This field is

useful for noting problems settling the payment.

§

: use to cancel the payment entry. Closes the page without saving anything.

: use to cancel the payment entry. Closes the page without saving anything.

§

: use

to proceed to the next step of the payment entry process which is paymet

distribution.

: use

to proceed to the next step of the payment entry process which is paymet

distribution.

Payment

Distribution:

Used to apply payment to

Orders/Invoices. Payments that are

entered at the time an Order is entered are automatically applied to the Order. Payments entered using Payment Entry feature

are applied using this process which allows a single payment to be distributed

to multiple orders/invoices.

§

Company Name: lists the customer’s name.

§

Contact Name:

lists the contact’s name.

§

Payment Type: lists the payment type entered in

Step 2.

§

Payment Amount: lists the total amount of the

payment entered in Step 2.

§

Unapplied Amount: lists the amount of the payment that has not

been distributed.

Grid listing all Order/Invoices for the

selected customer including previous payment distributions if this option was

selected in Step 2.

§

Type:

indicates the order type. I = Invoice, D

= Debit Memo, C = Credit Memo.

§

Order/Invoice

#: lists the Order number the

distribution was made to.

§

Date:

list the date the distribution was made.

§

Total:

lists the total amount of the order.

§

Amount

Due: lists the unpaid amount of the order.

§

Applied

Amount: this is where you enter the

amount of the payment to apply to the Order listed on the row. Negative values can be entered to reverse

previous distributions. The Auto Apply

option can be used to auto fill this field.

§

: click on this to return to Payment Entry

Step 2 page where you can make changes, then return to this page.

: click on this to return to Payment Entry

Step 2 page where you can make changes, then return to this page.

§

: use to cancel the payment entry. Closes the page without saving anything.

: use to cancel the payment entry. Closes the page without saving anything.

§

: use to clear applied amounts.

: use to clear applied amounts.

§

: use to automatically apply the payment

starting with the oldest invoice first, applying to subsequent invoices in

chronological order until the payment amount is fully distributed. Any remaining unapplied amount is stored as a

credit memo.

: use to automatically apply the payment

starting with the oldest invoice first, applying to subsequent invoices in

chronological order until the payment amount is fully distributed. Any remaining unapplied amount is stored as a

credit memo.

§

: used when finished with distribution to go to

next step.

: used when finished with distribution to go to

next step.

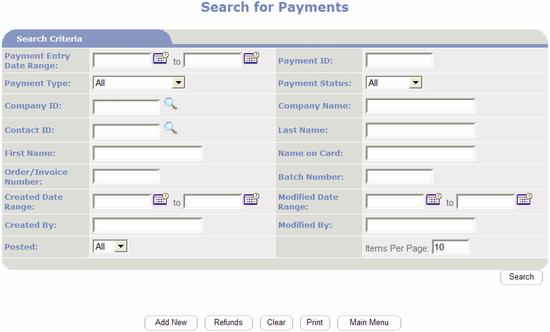

Search

for Payments:

Used to search and retrieve payments

that were previously entered.

§

Payment Entry Date Range: this searches on the date entered.

§

Payment

ID: this searches on the unique

record ID assigned to each payment.

§

Payment

Type: defaults to All. Provides option to search for a specific

payment type. The following payment

types are available:

o American

Express

o Cash

o Check

o Credit

Memo

o Debit

Memo

o Discover

o Master

Card

o Money

Order

o Refund

o Visa

§

Payment

Status: default to All. Provides

option to search for a specific status.

The following types are available:

o Approved

o Declined

o Pending

§

Company

ID: Provides option to search on

Company ID of payee.

§

Company

Name: Provides option to search on the Company Name of the payee.

§

Contact

ID: Provides option to search on the

Individual’s Contact ID of the payee.

§

Last

Name: Provides option to search on the Contact/payee’s Last Name.

§

First

Name: Provides option to search on the Contact/payee’s First Name.

§

Name on

Card: Provides option to search on the cardholder’s name.

§

Order /

Invoice Number: Provides option to search on Orders / Invoices the payment

has been distributed to.

§

Batch

Number: Provides option to search on

the payment posting batch number.

§

Created Date

Range – this searches on the date that is

automatically stored by the system when the payment record is created.

§

Modified Date

Range – this

searches by date last modified range.

Works the same as Created Date

Range.

§

Posted: defaults

to All. Setting to No eliminates posted payments from being retrieved. Set to Yes

to only include posted payments.

§

Items Per

Page – used to control how many matches are listed at a time. Defaults to 10. If the number of matches

is greater than the specified Items Per Page, PORTALPRODIGY provides navigation

options for the additional pages of matches This feature minimizes network

traffic.

Options:

|

|

Submits criteria to server and returns matching Payments.

|

|

|

Opens the Payment Entry Step 1 page to add a new payment.

|

|

|

Opens the Refund page.

|

|

|

Clears the search criteria.

|

|

|

Prints the website page to the user’s local printer.

|

|

|

Closes the page and returns to the Site Administration

Menu.

|