Used from administration to create and process credit

applications.

Company Section:

§

Company

ID: If the application is for a

Company, enter the unique Company ID assigned by PORTALPRODIGY.

§

Company

Name: If a Company ID was entered,

PORTALPRODIGY displays the Company Name.

§

Main

Contact Name: This is copied from

the Contact record and may be changed.

§

Federal

ID#: text field for entering a

Federal ID value.

§

Social

Security #: text field for entering

a Social Security value.

§

Other

ID#: text field for entering and ID

such as a Drivers License, Passport Number, etc.

§

Other ID

Description: text field for entering

a description of the type of ID used for Other ID.

§

Annual

Income: currency field for entering

annual income as a dollar amount.

Amounts entered with cents are rounded to nearest dollar amount.

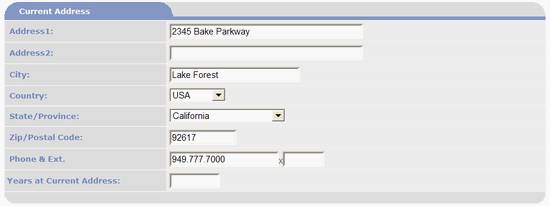

Current Address and Previous Address Sections:

§

Address 1

- enter the street address.

§

Address 2

- used when a second line is needed for the street address.

§

City:

enter the address City.

§

Country

– defaults to value specified in User Signup Features Management. List box lists all Countries that have been

activated in Countries Feature Management.

§

State/Province

– defaults to value specified in User Signup Features Management. If

Country is USA,

Mexico or Canada,

it lists the States/Provinces, for all other countries the list box is replaced

with a text box.

§

Zip/Postal

Code - enter the address postal Zip code

§

Years at

Current/Previous Address - enter the years the person lived at this address

as integer value. Decimals are rounded

to nearest whole number.

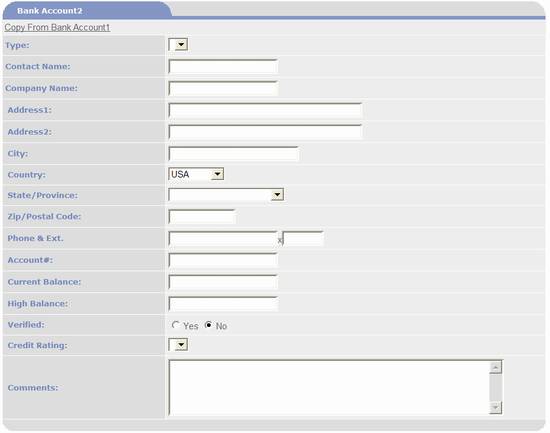

Bank Account 1

and Bank Account 2 Sections:

These two sections are for providing account

information for deposit accounts such as checking or money markets.

§

Copy

from Bank Account1 – this is a time saver that copies field values from

Bank Account1 section. Often a person

will have two or more accounts with the same Bank.

§

Type

– used to select a pre-defined value from list.

Bank Account Types are defined using Bank Account Type Management. Example values may include Checking, Savings, Money Market, etc.

§

Contact

Name – enter the contact persons name at the bank. Both first and last name are entered into

this field.

§

Company

Name – enter the name of the bank.

§

Address 1

- enter the Banks mailing street address.

§

Address 2

- used when a second line is needed for the street address.

§

City - enter

the mailing address City.

§

Country

– defaults to value specified in User Signup Features Management. List box lists all Countries that have been

activated in Countries Feature Management.

§

State/Province

– defaults to value specified in User Signup Features Management. If

Country is USA,

Mexico or Canada,

it lists the States/Provinces, for all other countries the list box is replaced

with a text box.

§

Zip/Postal

Code - enter the mailing address postal Zip code

§

Phone

& Ext. – enter the Bank Contact person’s phone number and phone

extension.

§

Account #

- enter the account number of the account.

§

Current

Balance – enter the current dollar amount in this account.

§

High

Balance – enter the highest dollar amount for this account.

§

Verified

– Yes and No radio buttons used to track account verification process. Default to No. Once the account has been verified to exist,

set to Yes.

§

Credit

Rating – used to select a predefined value from list. Values are defined using Credit Rating Management. Example values may include Paid as Agreed, Late Payments, Frequently

Late, In Default.

§

Comments

– used to enter textual comments about the accounts history, status and credit

rating.

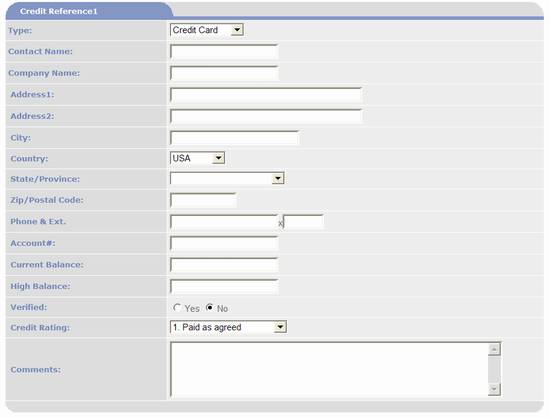

Credit Reference 1-3 Sections:

These three sections are for

providing information about borrowings.

§

Type

– used to select a pre-defined value from list.

Credit Types are defined using Credit Type Management. Example values may include Credit Card, Mortgage, Unsecured Loan,

etc.

§

Contact

Name – enter the contact persons name at the credit institution. Both first and last name are entered into

this field.

§

Company

Name – enter the name of the credit institution.

§

Address 1

- enter the credit institution’s mailing street address.

§

Address 2

- used when a second line is needed for the street address.

§

City - enter

the mailing address City.

§

Country

– defaults to value specified in User Signup Features Management. List box lists all Countries that have been

activated in Countries Feature Management.

§

State/Province

– defaults to value specified in User Signup Features Management. If

Country is USA,

Mexico or Canada,

it lists the States/Provinces, for all other countries the list box is replaced

with a text box.

§

Zip/Postal

Code - enter the mailing address postal Zip code.

§

Phone

& Ext. – enter the credit institution’s Contact person’s phone number

and phone extension.

§

Account #

- enter the account number of the account.

§

Current

Balance – enter the current dollar amount owed for this account.

§

High

Balance – enter the historical highest dollar amount owed for this account.

§

Verified

– Yes and No radio buttons used to track account verification process. Default to No. Once the account has been verified to exist,

set to Yes.

§

Credit

Rating – used to select a predefined value from list. Values are defined using Credit Rating Management. Example values may include Paid as Agreed, Late Payments, Frequently

Late, In Default.

§

Comments

– used to enter textual comments about the accounts history, status and credit

rating.

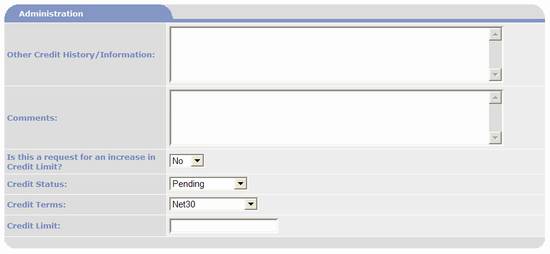

Administration Section:

Used as part of the approval

process to capture notes and record outcome.

§

Other

Credit History/Information – enter additional accounts and credit

information here.

§

Comments

– enter comments about credit verification here.

§

Is this a

request for an increase in Credit Limit? – set to Yes when the customer already has credit and is asking for an

increase in the amount; otherwise leave set to No.

§

Credit

Status – the following fields are used to track the status of the credit

application and to trigger record updates:

o

Pending

– PORTALPRODIGY assigns this value when the application is submitted by the

customer/visitor or when it is created by an Administrator.

o

Approved

– when this value is selected, PORTALPRODIGY updates the applicants account record

assigning them the Terms and Credit Limit specified below.

o

Declined

– select this value when the application is disapproved.

o

Not

Completed – PORTALPRODIGY assigns this value when the customer/visitor has

not completed their application. I.e.

They have saved it but not submitted it as completed.

§

Credit

Terms – used to assign credit terms.

Select one of the pre-defined Credit Terms. Credit terms are defined using Credit Terms

Management.

§

Credit

Limit – enter the credit limit dollar amount. This amount is copied to the customer’s

account when the application is approved.

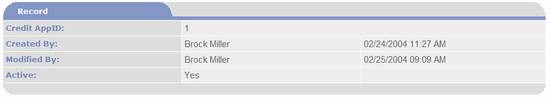

Record Section:

§

Credit

AppID – the unique record ID assigned by PORTALPRODIGY.

§

Created

By – the name of the user that created the record and the date it was

created. Lists user’s first name

followed by last name.

§

Modified

By – the name of the user that last modified the record and the date it was

last modified. Lists user’s first name

followed by last name.

§

Active

– by default this value is set to “Yes”, which means the record is active and

available for use. To deactivate a

record, set it to “No”. Deactivating a

record is a logical form of deletion. It

is used to remove the record from future use, yet maintain the relationship

with existing data. Reports by default

only include active records; however, there is a reporting option that allows

inclusion of deactivated records.